In a significant development that signals potential shifts in US-Japan trade relations, Treasury Secretary Scott Bessent has been tapped to lead high-level negotiations with Japan following the implementation of steep tariffs by the Trump administration. This blog post explores the key players, issues at stake, and potential implications of these critical trade talks.

Bessent Takes the Lead: A New Chapter in US-Japan Trade Relations

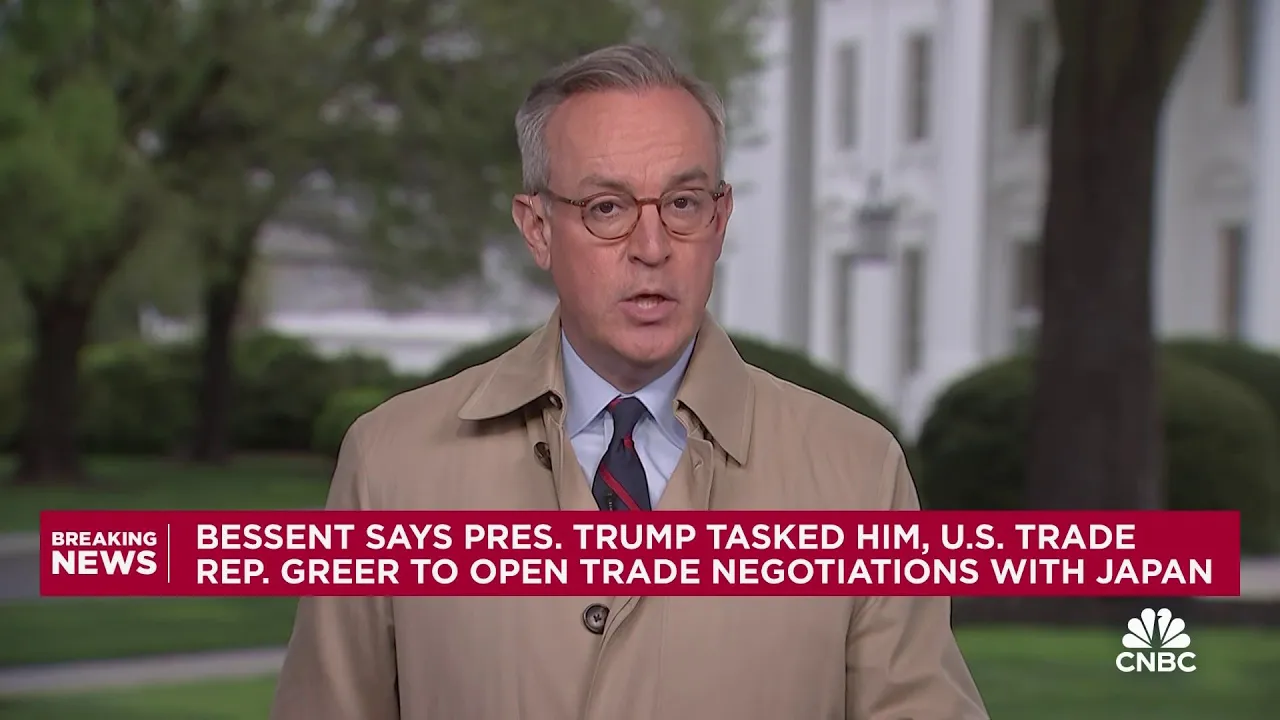

Treasury Secretary Scott Bessent announced Monday that he will lead trade negotiations with Japan, making the announcement on social media platform X (formerly Twitter). In his post, Bessent revealed that President Donald Trump has tasked him and US Trade Representative Jamieson Greer "to open negotiations to implement the President's vision for the new Golden Age of Global Trade" with Japan Nikkei Asia1.

Japan is poised to receive priority status in the wave of trade negotiations following Trump's sweeping tariff announcements. "They came forward very quickly," Bessent noted in comments to media outlets, explaining Japan's front-of-the-line position WSJ2.

The Stakes: Tariffs and Their Impact on Japan

The urgency of these talks stems from the significant economic impact of Trump's recent tariff announcements on Japan's export-dependent economy. The measures include:

- A 25% tariff on all car imports, which took effect last Thursday

- An additional 24% reciprocal tariff on other Japanese goods Reuters3

Analysts have projected these tariffs could potentially knock as much as 0.8% off Japan's export-driven economic growth, representing a significant blow to an economy heavily reliant on its automotive and manufacturing sectors Reuters3.

Japan's Response: Disappointment and Diplomatic Engagement

Japanese Prime Minister Shigeru Ishiba has made his displeasure with the tariffs clear, while simultaneously working to establish diplomatic channels to address the issue.

"I told him that his tariff policies are extremely disappointing and urged him to rethink them," Ishiba said, referring to a Monday telephone conversation with President Trump Reuters3.

Despite this strong statement, Japan is responding constructively by rapidly assembling a negotiation team. Japanese Economy Minister Shigeyuki Akazawa, a close aide to Prime Minister Ishiba, has been appointed to lead Japan's side of the discussions, signaling the high priority and importance Tokyo places on these talks Kyodo News4.

Beyond Tariffs: The Currency Dimension

A unique aspect of these negotiations is the inclusion of currency issues on the agenda. The talks will cover not only tariffs but also "exchange rates," with the yen being a focal point of discussions Nikkei Asia1.

Scott Bessent's background makes him particularly well-suited to lead discussions that involve currency matters. As an investor and hedge fund manager with extensive experience in global macro investments, Bessent has a history of making significant currency trades, including a notable bet against the Japanese yen during his time at Soros Fund Management Wikipedia5.

Bessent: The Macro-Focused Treasury Secretary

Bessent brings a unique background to these negotiations that differs from the typical Treasury Secretary profile. With a career rooted in hedge fund management rather than traditional investment banking, he offers a macro-oriented perspective to the trade talks.

His professional journey includes:

- Founding Key Square Group, a global macro investment firm

- Serving as Chief Investment Officer at Soros Fund Management from 2011 to 2015

- Running his own hedge fund from 2000 to 2005

- Working at Brown Brothers Harriman and Kynikos Associates early in his career Wikipedia5

Bessent graduated from Yale University in 1984 with a Bachelor of Arts in political science, where he was an active campus leader, serving as editor for The Yale Daily News and president of the Wolf's Head senior society Wikipedia5.

Market Reactions and Economic Implications

Financial markets have responded positively to the news of potential trade negotiations between the US and Japan. The Nikkei Stock Average surged 6% on Tuesday, rebounding after a 7.8% drop on Monday following the initial tariff announcements WSJ2.

This recovery reflects investor optimism that Japan might secure favorable terms in the upcoming negotiations, potentially mitigating the impact of the tariffs on Japanese exporters.

The Broader Context: Trump's "Golden Age of Global Trade"

These negotiations with Japan are part of a larger vision articulated by the Trump administration for reshaping global trade relationships. Bessent has framed the talks as implementing "the President's vision for the new Golden Age of Global Trade" Nikkei Asia1.

The administration appears to be using tariffs as leverage to prompt negotiations rather than as an end goal in themselves. Bessent has expressed optimism about the potential for "good deals" emerging from these discussions, suggesting that the negotiation process could yield mutually beneficial outcomes for the United States and its trading partners Bloomberg6.

Looking Ahead: Potential Outcomes and Timeline

While a specific timeline for the talks has not been announced, the urgency expressed by both sides suggests that negotiations could progress rapidly. Bessent has indicated that he expects "a couple big deals very quickly," signaling the administration's eagerness to demonstrate progress The Hill7.

Several potential outcomes could emerge from these negotiations:

- Comprehensive Trade Deal: A broad agreement addressing tariffs, non-tariff barriers, and currency issues.

- Sectoral Agreements: Focused deals on specific industries, with automotive likely taking priority given the 25% tariff's impact.

- Currency Understanding: Agreements related to exchange rate policies and interventions.

- Partial Tariff Rollbacks: Selective reductions in tariffs in exchange for concessions from Japan.

Conclusion: A Critical Juncture in US-Japan Economic Relations

The appointment of Scott Bessent to lead trade negotiations with Japan marks a pivotal moment in the economic relationship between these long-standing allies. With both tariffs and currency issues on the table, these talks could reshape trade patterns between the world's largest and third-largest economies for years to come.

As negotiations unfold in the coming days and weeks, the global economic community will be watching closely to see whether Trump's tariff strategy yields the "good deals" that Bessent has promised, or whether this approach creates lasting friction in one of America's most important economic partnerships.

For Japanese exporters, particularly in the automotive sector, the stakes couldn't be higher. For American consumers and businesses dependent on Japanese goods, the outcome of these negotiations will determine the availability and affordability of everything from cars to electronics in the months ahead.

This blog post combines information from multiple reliable sources including Reuters, The Wall Street Journal, Nikkei Asia, and official statements from both U.S. and Japanese officials to provide a comprehensive overview of the developing trade negotiations.